Mortgage rates move higher ... but not in South Florida

By Palm Beach Business.com

DELRAY BEACH – Mortgage rates pushed higher this week as yields rose on long-term bonds.

DELRAY BEACH – Mortgage rates pushed higher this week as yields rose on long-term bonds.

Freddie Mac’s Primary Mortgage Market Survey found the average 30-year fixed-rate mortgage at 5.08 percent with an average 0.7 point, up from last week’s 4.99 percent. Last year at this time, the 30-year averaged 4.78 percent.

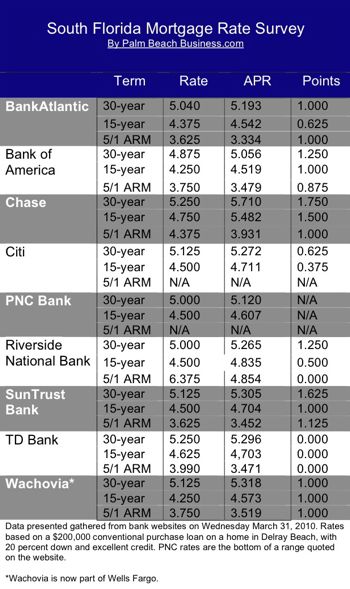

Palm Beach Business.com’s South Florida Mortgage Survey found the 30-year averaging 5.088 percent, with 1.0625 points, among banks serving the region. A week ago, rates averaged 5.094 percent.

“Interest rates for fixed mortgages rose this week following a run up in long-term bond yields, while ARM rates eased slightly,” said Frank Nothaft, Freddie Mac vice president and chief economist. “Rates on 30-year fixed loans were the highest since the starting week of this year.”

Also from the Freddi Mac survey: the 15-year averaged 4.39 percent with an average 0.6 point, up slightly from last week when it averaged 4.34 percent

The 5-year adjustable-rate mortgage averaged 4.10 percent this week, with an average 0.6 point, down from last week’s 4.14 percent.

The 1-year ARM averaged 4.05 percent this week with an average 0.6 point, down from last week when it averaged 4.20 percent. At this time last year, the 1-year ARM averaged 4.75 percent.

Mortgage rates are expected to rise as the Federal Reserve stopped buying mortgage-backed securities at the end of March.