Mortgage rates fall nationally and in South Florida

By Palm Beach Business.com

DELRAY BEACH — Mortgage mavens Freddie Mac and Bankrate.com say rates fell nationally during the past week, and Palm Beach Business.com’s South Florida Survey found regional banks following suit.

DELRAY BEACH — Mortgage mavens Freddie Mac and Bankrate.com say rates fell nationally during the past week, and Palm Beach Business.com’s South Florida Survey found regional banks following suit.

However, the low rates might not last, especially in light of the Federal Reserve’s decision to stop buying mortgage-back bonds later this month.

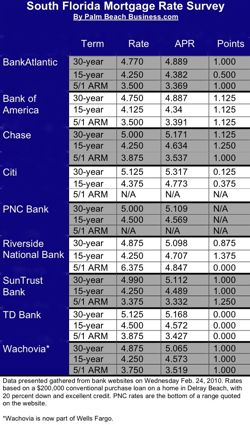

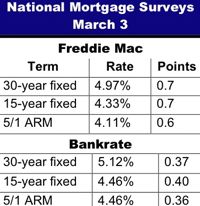

Freddie Mac’s Primary Mortgage Market Survey spotted the average 30-year fixed-rate mortgage at 4.97 percent with 0.7 point, down from last week’s 5.05 percent. Last year at this time, the 30-year FRM averaged 5.15 percent.

Bankrate put the average 30-year fixed mortgage at 5.12 percent with 0.39 discount and origination points, down from 5.15 percent a week ago.

The South Florida Survey found local banks generally either dropping the 30-year or holding it steady from last week’s rate. For example, BankAtlantic dropped the rate for the 30-year to 4.79 percent, with one point, from 4.85 percent a week ago. Wachovia, now part of Wells Fargo, dropped to 4.875 percent from 5.0 percent.

Meanwhile, the 15-year dropped to 4.33 percent from 4.40 percent a week ago, as surveyed by Freddie Mac. Bankrate said the 15-year dropped to 4.46 percent, tying its record low.

Meanwhile, the 15-year dropped to 4.33 percent from 4.40 percent a week ago, as surveyed by Freddie Mac. Bankrate said the 15-year dropped to 4.46 percent, tying its record low.

"30-year fixed mortgages fell below 5 percent to match levels seen two weeks ago and are helping to maintain affordable home-purchase conditions," said Frank Nothaft, Freddie Mac vice president and chief economist. "In fact, monthly principal and interest mortgage payments for a typical family buying a median-priced home of $163,800 were just $709 in January, the lowest amount since February 1998, according to the National Association of Realtors. For first-time homebuyers, the fourth quarter of 2009 was the third most affordable quarter since 1981 behind the first and second quarter of 2009.”

Bankrate said nervousness over the strength and sustainability of the economic recovery has helped keep rates low, and pushed them lower this week. However, mortgage rates could start marching higher in the coming weeks as the Federal Reserve stops buying mortgage-backed securities. The Fed gets much of the credit for the ultra-low mortgage rates enjoyed over the past 16 months, because it’s been the primary buyer of mortgage bonds in that time.

Mortgage rates were last above 6 percent in November 2008, right before the Fed began those purchases.

Bankrate’s panel of mortgage experts sees rates either most likely either rising or staying put over the short term. None of the panelists sees rates dropping further.